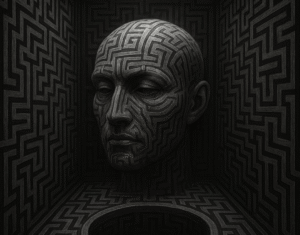

Feel Lost in the Maze?

Zoom Out

“If one does not know to which port one is sailing, no wind is favorable.” – Seneca

Markets feel like a maze because they are one—narrow corridors of noise, bright dead ends, and only a few paths that actually lead somewhere. When you’re pressed against the wall, the next turn looks like everything. When you gain altitude, the plan becomes clear.

This article is your map—compact, practical, and built around four rules:

Equity curve over last trade for context

Risk-of-ruin over win rate for longevity

Sample size over stories for truth

- Tiered clarity for direction

Key Terms ExplainedBefore diving in, here are the core concepts in plain terms:

- Equity curve: A graph tracking your account balance over time, like a health monitor for your trading performance.

- Drawdown: The decline from your highest balance to the lowest point, measuring the extent and impact of losses.

- 1R (risk unit): The amount you plan to risk on a single trade if it goes against you (e.g., $50 per trade means 1R = $50).

- Expectancy: The average profit per trade, expressed in R units. Formula:

Expectancy = (Win rate × Average win in R) – (Loss rate × 1R). - Risk-of-ruin (RoR): The probability of reaching a critical loss level (e.g., -20%) that forces you to stop trading.

- Correlation: When multiple positions move in sync, turning diversified trades into a single, amplified bet.

Rule 1: Focus on the Equity Curve, Not the Last Trade

Key Metrics to Monitor

- Overall slope: A steady upward trend, even if gradual, signals progress. Persistent flatness or declines warrant adjustments.

- Volatility: Excessive fluctuations can erode discipline. Aim for manageable variability.

- Drawdown details: Assess both depth (how much you lose) and duration (how long recovery takes), as prolonged slumps affect morale.

- Market regimes: Note shifts (e.g., high volatility periods) to identify when your approach performs best.

Weekly Routine (15 Minutes)

- Annotate key events: Record adjustments like “Adjusted stops on Tuesday” or “Reduced position size on Friday.”

- Label the week: Categorize as “Trending,” “Choppy,” or “Volatile.”

- Implement one change: Avoid overhauling multiple elements simultaneously to maintain clarity.

Example

- Account balance: $5,000

- Risk per trade (1R): $25

- Weekly results: +2R, -1R, +1R, -1R, +0.5R = Net +1.5R (+$37.50)

A single loss doesn’t define success; the weekly trend does.

Insight: Prioritize the broader narrative over isolated events.

Rule 2: Prioritize Risk-of-Ruin Over Win Rate

- Ruin threshold: Set a “stop-out” level, such as -20% from peak equity, triggering a mandatory review.

- Per-trade risk: Limit to 0.25%-0.5% of your account (e.g., $12.50-$25 on a $5,000 balance).

- Loss caps: Enforce daily (e.g., 2R) and weekly (e.g., 5R) limits; halt trading upon reaching them.

- Correlation limits: Cap exposure to similar ideas (e.g., max 2R across tech stocks).

- Reward ratio is key: A 40% win rate with 2.5R average wins can outperform a 60% win rate with 1R wins.

- Loss streaks occur: Correlated positions can amplify drawdowns.

- Unexpected events: Gaps or outliers can devastate oversized trades.

- Win rate: 40%

- Average win: 2.5R

- Loss: 1R

With 1R = $25, this yields an average +$10 per trade—sustainable if risks are controlled.Simple RoR CheckSimulate: “What if I face 10 consecutive losses?”

- At 0.5% risk ($25 per trade): -5R = -$125 (manageable).

- At 2% risk ($100 per trade): -20R = -$2,000 (potentially ruinous on $5,000).

Rule 3: Rely on Sample Size, Not Narratives

The traps

Narrative fallacy: We retrofit meaning to randomness—especially after big wins or losses.

Overfitting theater: The more knobs you turn, the better the backtest “looks.” The maze rewards robust, boring rules.

Selective memory: Dramatic trades stick; typical ones vanish.

- Target 100+ trades per setup across varied conditions for confidence.

- For quicker insights, commit to 30-50 trades with unchanged rules, then analyze.

- Tag trades for grouping (e.g., by market regime).

- Avoid bias: Emotions amplify meaning in isolated wins or losses; data provides balance.

- Prevent overfitting: Excessive tweaks optimize for past data but fail in new conditions.

- Entry criteria.

- Stop placement (where the idea invalidates).

- Exit rules.

- Position size (0.25%-0.5R).

- Filters (e.g., time of day).

Rule 4: Achieve Clarity Through Structured Reviews

- Questions: Did I adhere to rules? Was sizing appropriate?

- Actions: Use a pre-market plan and checklist; enforce loss limits.

- Adjustment: Address one inefficiency (e.g., refine alerts).

- Questions: How did the equity curve perform? Which setups contributed positively?

- Actions: Annotate changes; compare tagged groups.

- Adjustment: Modify one element (e.g., entry filter).

- Questions: Is the strategy mix suitable? Are correlations managed?

- Actions: Simulate RoR with recent data; update risk allocations.

- Adjustment: Refine overall framework.

Common Maze Illusions (Ignore Them)

Recency bias: Last trade ≠ next trade.

Gambler’s fallacy: Losses don’t “owe” you a win. Clusters happen.

Hot-hand bias: Streaks tempt oversizing; they don’t expand your edge.

Complexity theater: More rules ≠ more robustness.

Benchmark envy: Your benchmark is the risk you chose, not someone else’s screenshot.

Bringing It Together

Think of these four rules as the compass you carry through the maze:

Equity curve over last trade — Judge the picture, not the pixel.

Risk-of-ruin over win rate — Survive first; scale second.

Sample size over story — Believe data before narratives.

Clarity is altitude — Schedule your vantage points.

Mike Voss